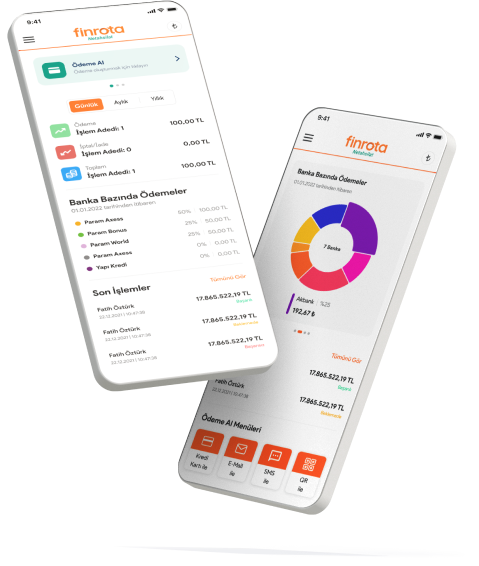

Netahsilat

Online Collection System

It provides fast and secure payments from dealers, subscribers, customers, users with unlimited POS integration and advanced collection methods.

Integrated ERPs

Netahsilat allows you to integrate with SAP accounting systems and Logo Yazılım

Remote Collection

It allows you to receive payments in the field with a smart phone, tablet and mobile application without a pos machine.

Collection via SMS, E-mail, QR

It allows you to make your collection by sending a payment link to dealers, customers and members via SMS, E-mail and QR.

Secure Infrastructure

There is a 3D Secure compatible collection infrastructure that includes PCI DSS and ISO 27001 security standards.

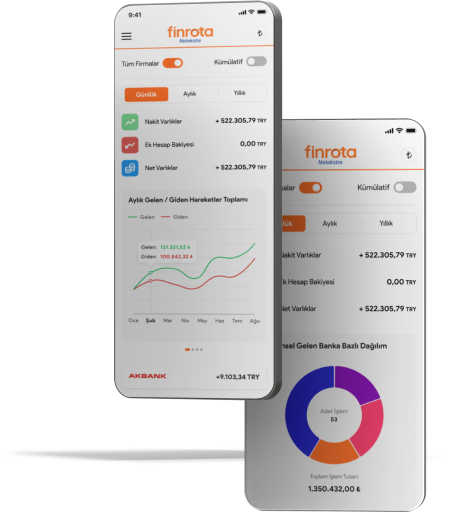

NetEkstre

Your bank account transactions are on a single panel.

With NetEkstre, which offers Open Banking solutions, you can monitor all your bank accounts from a single panel and receive detailed reports and notifications.

Single Panel

Since you can follow all your bank/account activities from a single panel, you will be able to see the previous day's turnover balance and the instant balance.

Accounting-ERP Integration

With flexible rule definitions, you will be able to use it in your ERP/accounting software integrated with high security performance.

Saving time

Since the system can be viewed with a single panel, you can use your time efficiently without logging into all the bank accounts you work with with a separate password.

Consolidated Graphical Reports

You can see all your bank/account statuses with instant graph reports on a daily-weekly-monthly basis.

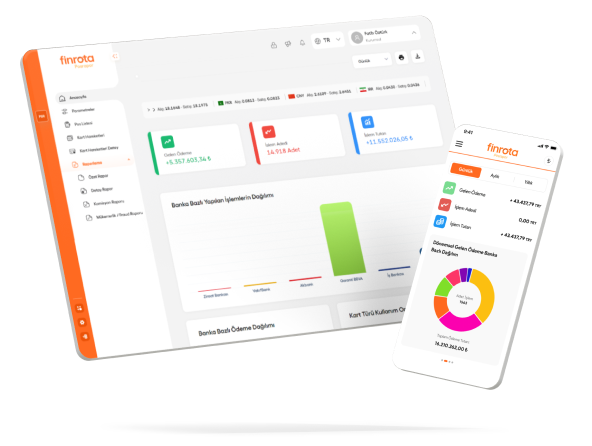

Posrapor

Your physical and virtual POS transactions are in one panel.

With the POS tracking system Posrapor, you can easily track your physical and virtual POS transactions, installment, commission, maturity information and many more from a single screen, and get detailed reports.

Physical POS Transaction Integration

Automatically integrate the amount, commission, value date and other bank movements of the collections you make with the POS machines you are using into your ERP/accounting.

Virtual POS Transaction Integration

Automatically integrate the amount, commission, value date and other bank movements of the collections you make with your virtual POS into your ERP/accounting.

Admin Panel and Detailed Reporting

View bank transactions of Physical POS and Virtual POS transactions in a single panel. Export in Excel and txt formats, print out from the printer.

Bank Integrations

Integrate your Ziraat, Vakıfbank, Halkbank, Garanti, Yapı Kredi, Akbank, İşbank, Alternatifbank, Kuveyttürk, Finansbank, Denizbank, Teb and Şekerbank pos transactions into your ERP/accounting with a single integration.

E-DBS

Easily manage your collections in all banks.

Easily manage your collections online on a single platform with the cash management service DBS and the direct debit system in different banks.

Automatically uploads invoices

Upload invoices to all integrated banks easily from a Single Panel. Manage your results.

Guarantees your collections

With Credit DBS, you can get fast and guaranteed collections from your dealers.

Checks balance

Check the available limits of your dealers, who have limits in integrated banks, from a single screen.

Provides ERP integration

Thanks to the integration, both uploading invoices and posting the results to the current account in one go.

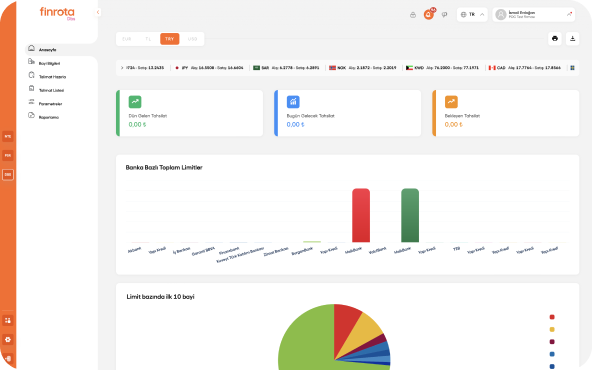

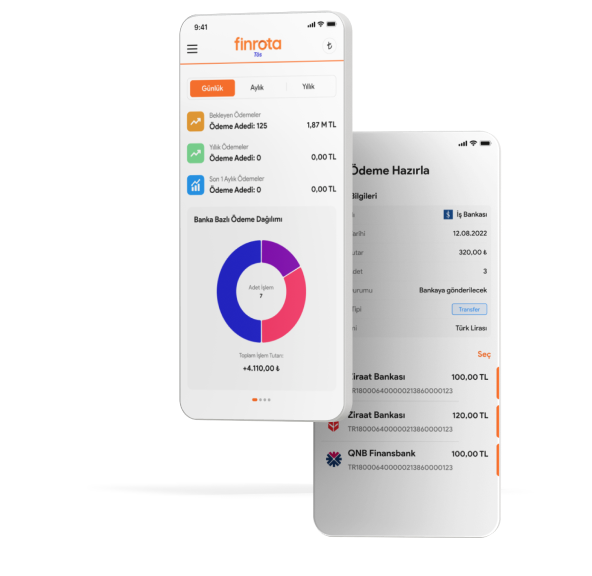

TÖS

Bulk payment system transactions in one panel.

It enables your company to perform bulk money transfer transactions such as EFT, Money Order, SWIFT from more than one bank and account at a time.

Simultaneous Money Transfer to All Banks

Payments are made quickly as money transfers in many banks start at the same time. Your suppliers and customers will be happy.

Advanced Approval Structure

You can set up consent structures and distribute roles for on-premises users.

Saving time

It saves time by eliminating the processes of uploading payment lists to the bank one by one.

Advanced Analysis Reporting

It shows the realized, undelivered and pending payments on the frontend. It provides detailed analysis on a daily, weekly, monthly basis or according to the criteria you specify.

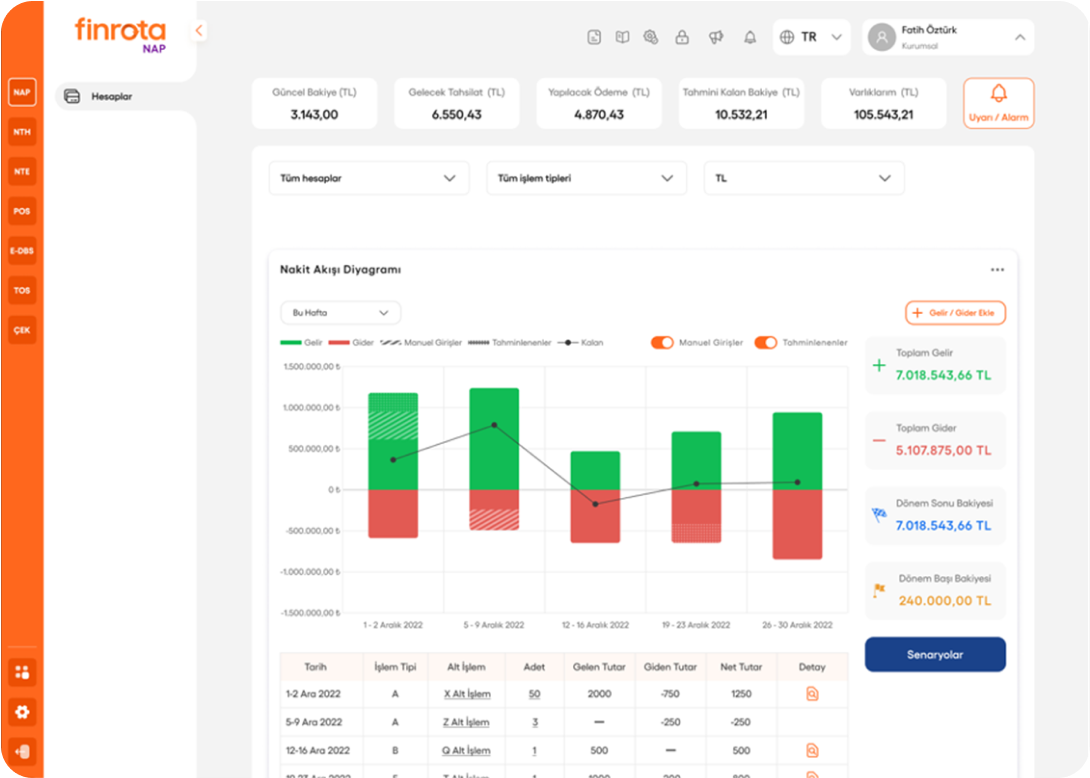

NAP360

View all your cash flow in one place.

With the help of artificial intelligence, it processes data and produces reports, future predictions, reminders and suggestions. It makes it easier for financial management to make decisions.

Receivable and Debt Tracking

You can track your receivables from customers and your debts to vendors and suppliers.

Income/Expense Forecast

Artificial intelligence examines your past transactions and payments, predicts your future payments, and provides reports and analysis.

Exchange Rate Entry

You can enter the rate you foresee in the future and create your cash flow table according to the new rate.

Warnings and Alarms

You can create warnings and alarms on a transaction basis, and you will be notified in advance if there is a risk that your cash flow will go negative at a later date.