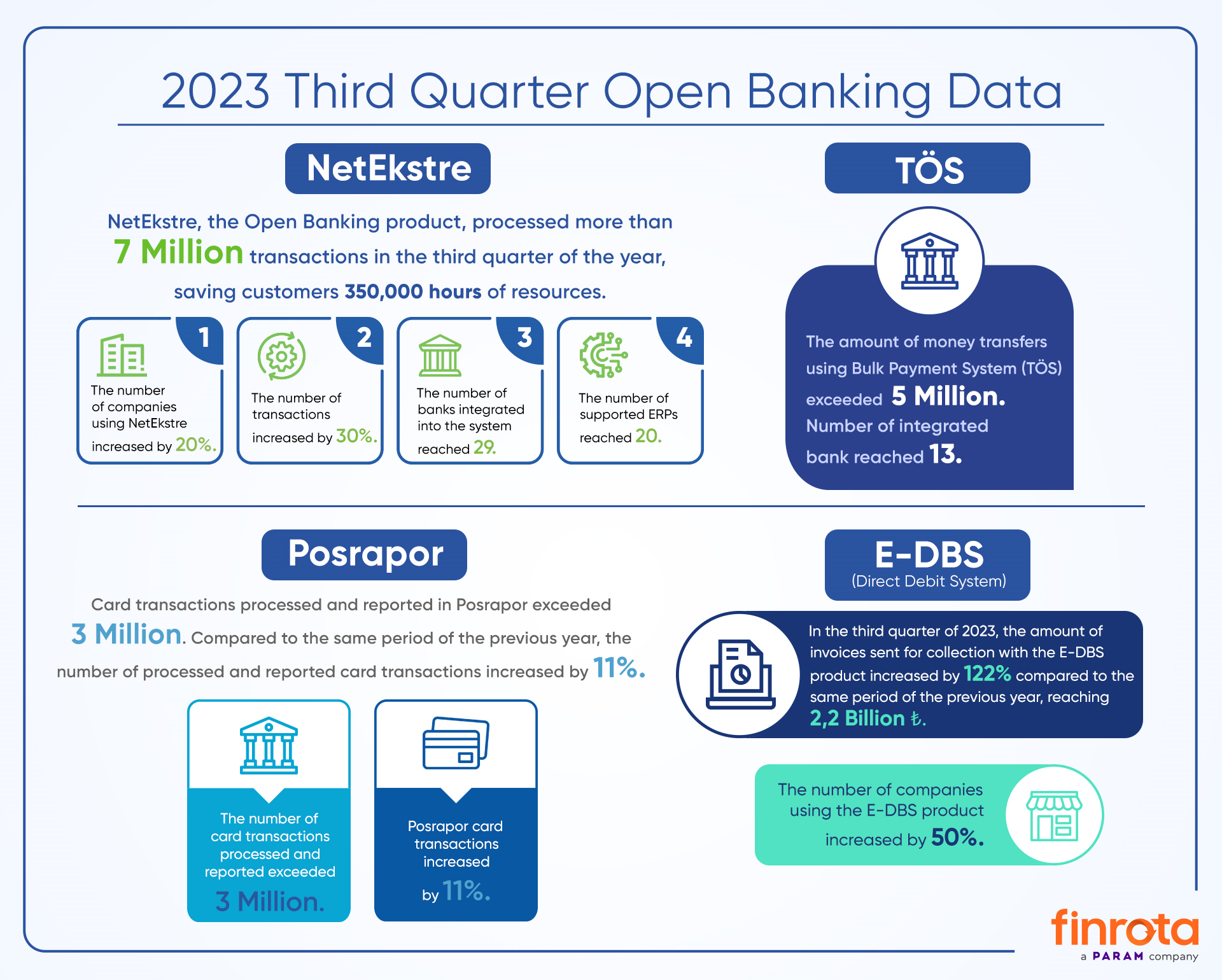

The number of transactions reported by Finrota's open banking product NetEkstre in the third quarter of 2023 increased by 30 percent compared to the same period last year. Thus, NetEkstre's number of account transactions exceeded 7 million and it saved its customers 350 thousand hours of resources.

NetEkstre, the most preferred open banking product that offers the opportunity to manage different bank transactions on a single screen, increased its transaction volume in the third quarter of 2023. NetEkstre's total number of transactions increased by 30 percent compared to the same period last year and exceeded 7 million. The number of companies using NetEkstre product increased by 20 percent.

According to the data in the third quarter of the year, NetEkstre classified and reported more than 7 million account transactions. NetEkstre users saved more than 350 thousand hours in their customers' accounting transactions. The number of account banks integrated into the system is 29, the number of card banks is 3, and the number of supported ERPs is 22.

Company credit cards on a single screen with NetEkstre

By completing its integrations with NetEkstre, İş Bankası, Yapı Kredi and Denizbank, it enables you to manage all bank accounts from a single screen as well as display company credit cards from a single screen. NetEkstre aims to offer tracking of company cards of more banks to customers by the end of the year.

Card transactions processed and reported in Posrapor exceeded 3 million

Card transactions processed and reported in Posrapor, the reporting system among Finrota's Open Banking services, continued to increase in the third quarter of the year. Reported card movement increased by 11 percent compared to the same period in the previous year. Posrapor, which offers detailed reporting opportunities and easily displays transactions of different banks and payment institutions in a common database, also helps manage cash flow by making it possible to track commission change, maturity and blocked employee date and amount information.

The amount of invoices sent to collection with the E-DBS product broke a record with 2.28 billion TL.

E-DBS (Electronic Direct Debit System), the cash management system that provides financial advantages to companies, continued to show high performance in the third quarter of 2023. In this period, the amount of invoices sent to collection with the E-DBS product increased by 122 percent compared to the same period of the previous year and reached 2.28 billion TL. The number of companies using the E-DBS product increased by 50 percent. Companies with a wide customer network or dealers automatically collect invoices for goods and services sales made with the E-DBS system. Companies benefiting from E-DBS, which offers the opportunity to manage transactions in different banks from a single panel with the direct debit system, can create instructions for the collection of their invoices and track their limits.

Advantageous working in transfer processes with TÖS

The transfer volume of TÖS (Collective Payment System), one of Finrota's fastest growing products, continues to grow. The amount of money transfers made using TÖS is It exceeded 5 million in the third quarter.

TÖS offers advantageous working opportunities in transfer processes; It can easily perform many transactions such as bulk money transfer transactions, EFT, money transfer, SWIFT, import payment, and by being integrated with ERP programs, it enables the payment to be entered and the paid records processed by automatically withdrawing the debts from the accounting program. Working in integration with banks, TÖS provides the opportunity to manage all transactions through a single portal, without the need for finance and accounting employees and managers to turn to different tools. Adding value to the Fintech sector, TÖS continues to make the lives of companies easier with its innovative features.

“The number of companies choosing NetEkstre increased by 20 percent”

Stating that NetEkstre continued to grow in the third quarter of the year, Finrota General Manager İlknur Uzunoğlu continued: “We achieved a 30 percent increase in the number of transactions at NetEkstre compared to the same period of the previous year. The number of companies choosing NetEkstre increased by 20 percent. We will raise this rate much higher in the coming period. Today, payment and collection transactions are among the areas where open banking applications have made the most progress. Developments in these areas shed light on the development of open banking. As Finrota, we continue to serve our customers with our modern and comprehensive product range that makes remote payments simpler and more secure. By integrating with different banks, we will offer our customers the tracking of accounts and company cards of more banks. “We will continue to work to improve our service quality in the areas our customers need and to create our customers' routes in financial technology.”