Open Banking product Netekstre saved 380,000 hours of resources in the first quarter of the year

Open Banking platform Netekstre's first quarter data of 2024 has been announced. While Netekstre users saved 380,000 hours of resources in financial tracking and accounting operations, the number of account transactions processed and reported exceeded 7 million.

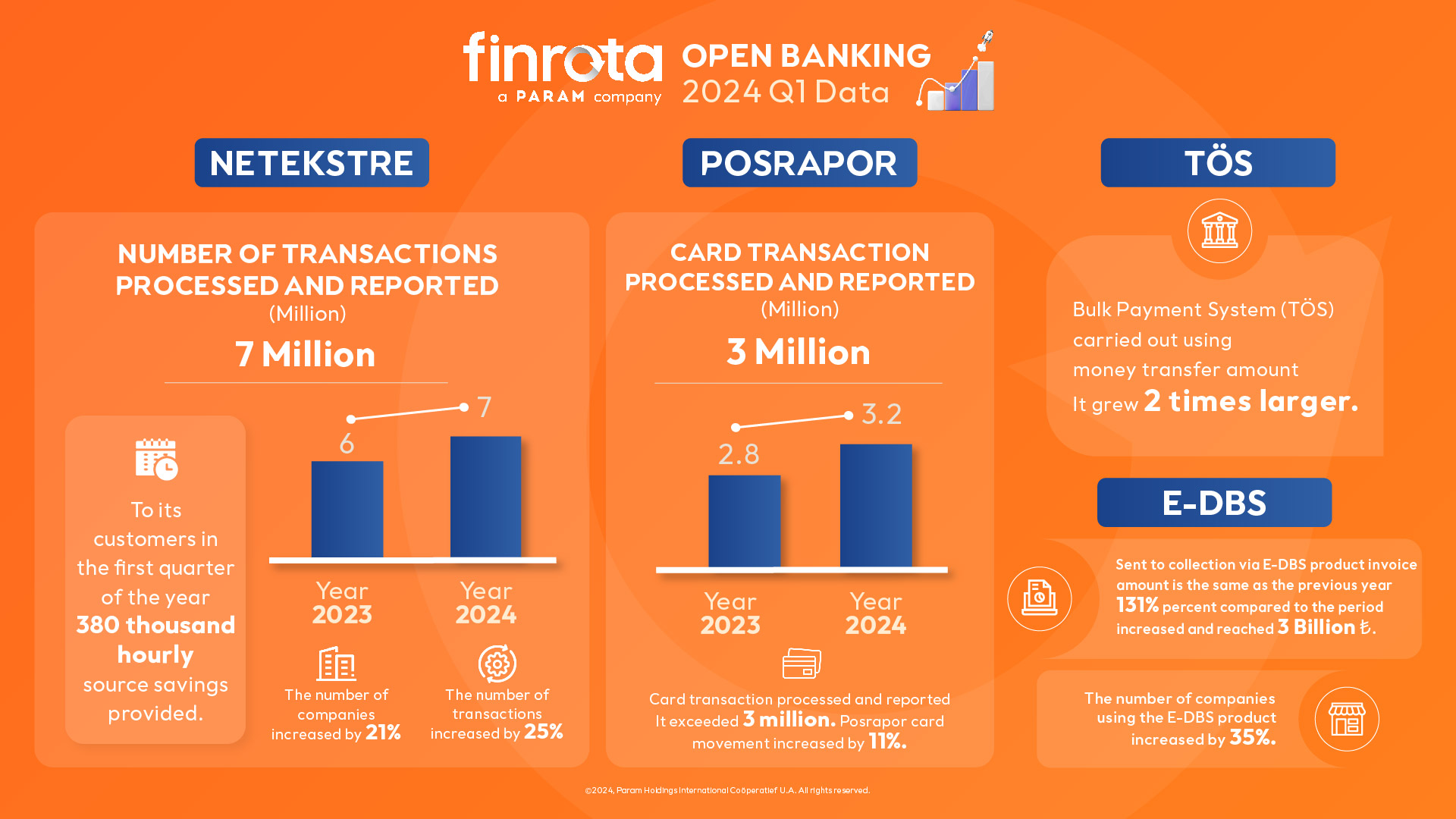

Netekstre once again reinforced its strong position in the sector by increasing its transaction rates in the first three months of the year. The number of transactions classified and reported in Netekstre exceeded 7 million, increasing by 25 percent compared to the same period last year. The number of companies using Netekstre, which classified and reported more than 7 million account transactions in the first quarter of 2024, increased by 21 percent. As of the first quarter of the year, the number of ERP systems supported reached 26. Thus, the benefit provided to customers was increased by not only viewing account transactions but also integrating into the preferred accounting or ERP program.

Netekstre offers its users the opportunity to manage different bank accounts from a single screen, thanks to its integration with many banks and payment systems. The advanced reporting features offered by Netekstre help users save significant time in financial tracking and accounting transactions. Netekstre saved 380,000 hours of resources in financial tracking and accounting operations.

Card transactions processed and reported in Posrapor exceeded 3 million

Card transactions processed and reported in Posrapor, the reporting system among Finrota's open banking services, exceeded 3 million in 2024, increasing by 11 percent compared to the same period of the previous year. The number of companies using Posrapor increased by 16 percent compared to the same period last year. Posrapor, which offers detailed reporting opportunities and easily displays the transactions of POS devices of different banks and payment institutions in a common database, also offers detailed reports containing many information such as commission change, maturity date, card program, number of installments. In addition to these, Posrapor; It also supports tracking blocked amounts awaiting maturity at POS devices and account transfer dates, thus managing cash flow.

The amount of invoices sent to collection with the E-DBS product increased by 131% and reached 3 billion TL.

E-DBS (Electronic Direct Debiting System), the cash management system that provides financial benefits to companies with the solutions it offers, started 2024 with a successful performance. As a matter of fact, according to the data in the first quarter of 2024, the amount of invoices sent to collection with the E-DBS product increased by 131 percent compared to the same period of the previous year and reached 3 billion TL. The number of companies using the E-DBS system increased by 35 percent. Companies with a wide customer network or dealers automatically collect invoices for goods and services sales made with the E-DBS system. Companies benefiting from E-DBS, which offers the opportunity to manage transactions in different banks from a single panel with the direct debit system, can create instructions for the collection of their invoices and monitor their limits more regularly and efficiently. E-DBS enables businesses to make transactions safely and quickly with its advanced security features and user-friendly interface.

TÖS's transfer volume doubled

The transfer volume of TÖS (Collective Payment System), one of Finrota's fastest growing products, doubled in the first quarter of 2024.

TÖS offers advantageous working opportunities in transfer processes; It can easily perform many transactions such as bulk money transfer transactions, EFT, money transfer, SWIFT, import payment, and by being integrated with ERP programs, it enables the payment to be entered by automatically withdrawing the debts from the accounting program and the paid records to be processed. Working in integration with banks, TÖS provides the opportunity to manage all transactions through a single portal, without the need for finance and accounting employees and managers to turn to different tools. Adding value to the Fintech sector, TÖS continues to make the lives of companies easier with its innovative features.

“We are pleased with the growth performance we achieved in the first quarter of the year”

Evaluating the first quarter data of 2024, Finrota General Manager İlknur Uzunoğlu said: “We closed the year 2023 with growth. We achieved very successful results in the first quarter of 2024. We are extremely pleased with the growth performance we achieved in the first quarter of the year. We will continue this success in the coming months. We constantly improve our products and services in the field of open banking by focusing on customer satisfaction and technological innovations. With Netekstre, we increase the financial efficiency of companies and enable them to save time and resources. In fact, we saved users 380,000 hours of resources in financial tracking and accounting operations. Netekstre strengthened its presence in the ecosystem in the first quarter of 2024 and recorded an increase in both the number of transactions and the time savings it provided to its customers. We exceeded 7 million in the number of transactions, increasing by 25 percent compared to the same period last year. With this product, we provide the opportunity to easily manage all bank account transactions and consolidate account information from a single screen. In addition, our business partners can transfer all account movements in their bank accounts to ERP/accounting systems online and thus have the opportunity to instantly monitor their bank account movements from a single panel. Card transactions processed and reported in Posrapor, another open banking product, exceeded 3 million in 2024, increasing by 11 percent compared to the same period of the previous year. The amount of invoices sent to collection with our E-DBS product increased by 131 percent compared to the same period in 2023, reaching 3 billion TL. The transfer volume of TÖS (Collective Payment System) doubled in the first quarter of the year. All these data reflect Finrota's strong position in the industry and the benefits of the services it offers. The growth rates we achieved in our open banking solutions in the first quarter of the year reinforce our strong position in the sector and further motivate us to achieve our goals. We will soon add a new artificial intelligence-based financial reporting product to our open banking services. This product of ours; will be able to make income and expense forecasts, examine past transactions and payments, and provide reports and analysis. In short, it will facilitate the decision-making processes of its users. We will contribute to the digital transformation of more users and business partners with each of our open banking services. “We will continue to chart the course of financial technology with our distinctive financial solutions.”