What is NetEkstre, Eçözüm Information Technologies product Netekstre, as a bank account statement service; It receives your account transactions from banks online and allows you to view all transactions on a single panel. It translates product account transactions into a common data structure and transfers them to ERP systems (SAP, Oracle, Microsoft, Logo, Netsis, etc.).

What is NetEkstre, How is it Used?

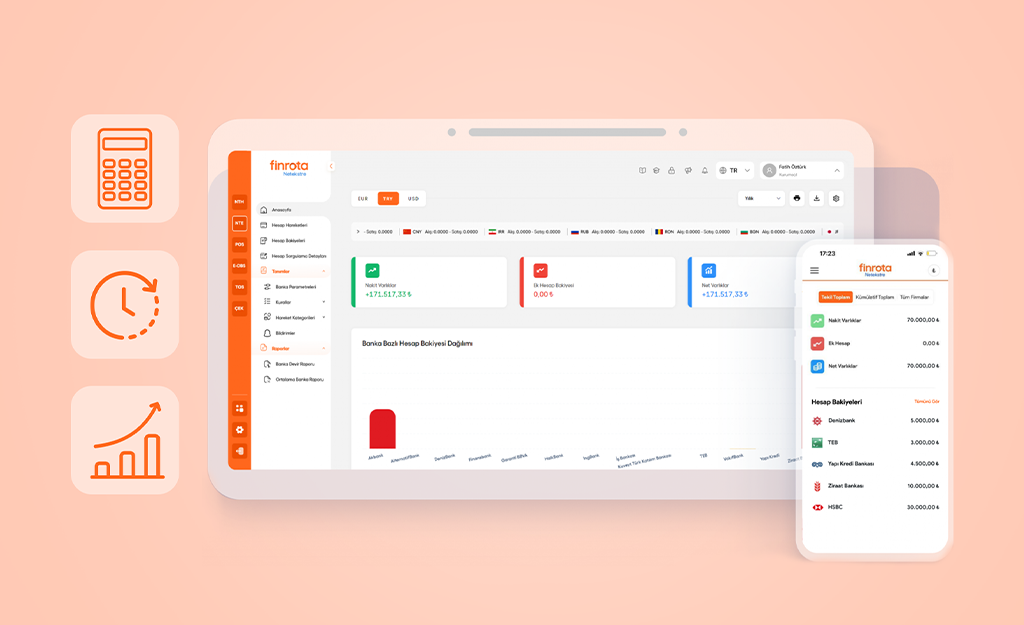

The product displays all bank accounts on a single screen in line with the needs of companies. It saves a lot of time required for transactions between accounts. Eçözüm Information Technologies has been developing e-collection, online collection, virtual pos and payment systems technologies since 2001. In line with the needs of the companies, NetEkstre has developed the product, which monitors all bank accounts on a single screen. What is NetEkstre, With the online account tracking system, all bank transactions can be viewed on a single panel and instant integration with accounting - ERP systems can be made. With the Netekstre product, companies will no longer have to enter the interfaces of banks separately to examine their accounts. Payments are tracked instantly and transfers are made instantly to all accounting - ERP systems. Detailed reports on accounts can be received daily, weekly and monthly, as well as instant notifications for all transactions can be easily received through the system.

NetEkstre Features Viewing all account activities in different banks on a single panel. Monitoring all transactions in accounts instantly from the panel. Instant integration into all accounting - ERP systems. (Direct integration with Logo, Netsis and Eta.) Preventing all erroneous transaction entries through integration. Reporting of account activities on a daily, weekly or monthly basis. Ability to receive instant notifications for all your transfer-eft transactions in the accounts. Ability to create current account and accounting slips at the same time. Ability to create perfect matching rules with bank transaction codes.

NetEkstre Demo Request

To get detailed information about the Net Extract system and to examine the system, you can call us (0212 256 60 00) or fill out a demo request form and have our customer representatives contact you. You can examine the banks integrated into NetEkstre bank account transactions management systems here.